Money Management Tips For Newlyweds

Money Management Tips

Learning to live together as husband and wife is exciting and wonderful, and now that your beautiful, romantic wedding and honeymoon are over, it's time for you and your hubby to be attentive to your finances. This time period sets the tone for your financial future.

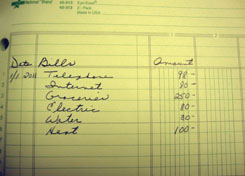

A good starting place is to sit down and itemize what you have in your savings and checking accounts. You also need to know how much money is in your 401 (k) account, any stock or bond investments that you have accumulated and any other assets such as: valuable collectibles, real estate, jewelry, cars and etc. You also should list your liabilities, including your student loans (if you have any) your credit card balances, car loans, loans from family or friends and etc.

Money Management Tips - Immediate Decisions

- Decide who will be the primary manager of your finances. Will one of you take on the entire task of managing your money or will it be a shared endeavor?

- Decide if you want to share one check book or do

you each want to keep your own check book. Keeping individual checking accounts is easier when it comes to writing checks and keeping

an accurate balance. Neither of you has to look for the check book and make

certain there is sufficient money in the account to write a particular

check. (The accounts and be either individual or joint accounts, whatever works for you.)

- Do you and your hubby have an adequate income to meet all of your bills?

- Make a budget that you and your sweetie are comfortable with and stick to your plan.

Additional Money Management Tips

- Your credit score is a number generated by a mathematical formula based on information contained in your credit report as compared to information on millions of other people. The end number is an accurate prediction of how likely you are to pay your bills.

- Take the time to learn your credit card scores by obtaining your credit reports. (If you need to borrow money, the higher your number the more likely you will receive a loan with a lower interest rate.)

- As of this writing you can use these numbers to order your credit reports: Equifax 1-800-685-1111 TransUnion 1-800-916-8800 Experian 1-888-397-3742

- Once you receive your credit reports check them carefully and if you determine there are errors, you can contact Equifax, TransUnion or Experian at: Experian NCAC P.O. Box 9556 Allen, TX 75013 Equifax Information Services P.O. BOX 740256 Atlanta, GA 30374 TransUnion Customer Disclosure Center Trans Union Consumer Relations P.O. Box 2000 Chester, PA 19022-2000

More Money Management Tips

- Remember to notify your creditors if you change your name. They will update your name with the credit reporting agencies when they report your account information.

- You and your hubby are sharing your lives, so share your credit reports with each other.

- Paying your bills on time and paying down your debt will raise your credit score.

- Contribute the maximum amount to your 401 (k) plan offered at work or Roth IRA if eligible, thus taking advantage of tax deferred earnings.

- If you racked up high balances on your credit cards to pay for your wedding, it's a good idea to pay down the credit cards that have the highest interest rates as soon as possible.

- Until you get your credit card balances under control, keep your new purchases to an absolute minimum. You can live without a big screen TV or new chair until you can pay with cash.

- Since the interest rates on school loans is usually much lower than credit card debt, make the minimum payment on your student loans until you have paid off your credit card debt. To determine if you qualify for a student loan tax deduction, check out the government web site at www.irs.gov/taxtopics/tc456.

- Learn about investing by talking to your family and friends, a financial adviser or an accountant, read books and articles or take a class to determine a plan of savings that will fit your budget.

- Be open and honest with each other, hiding money is a good way to lose confidence in each other.

- Communicate your concerns with each other so that you can make the best possible decisions regarding your financial future.

All of these money management tips are important so, if you have any questions or would like to share information on "Money Management Tips" please contact me through my contact button on the Navigation Bar.

Go from Money Management Tips to Unique Reception Theme Wedding Ideas Home

Guidelines for Tipping

Wedding Centerpiece Ideas

Pictures are copyrighted and cannot be used without written permission © 2008 - 2015 unique-reception-theme-wedding-ideas.com ® All Rights Reserved

Click Here to read our disclosure regarding affiliate and advertising sponsors.